Long Term Care Plans

LTC

Long-term care (LTC) insurance covers nursing-home care, home-health care, personal or adult day care. This can help insure your retirement savings don't need to be spend on these costs.

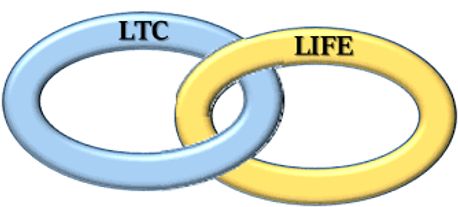

Linked LTC

Unlike traditional life insurance, which just provides a death benefit, or long-term care insurance that only pays for qualifying expenses, a linked benefit policy has a death benefit, maintains a cash value and can provide income tax-free payments for qualified long-term care related expenses. This can be a great vehicle to take care of 2 needs with one product.